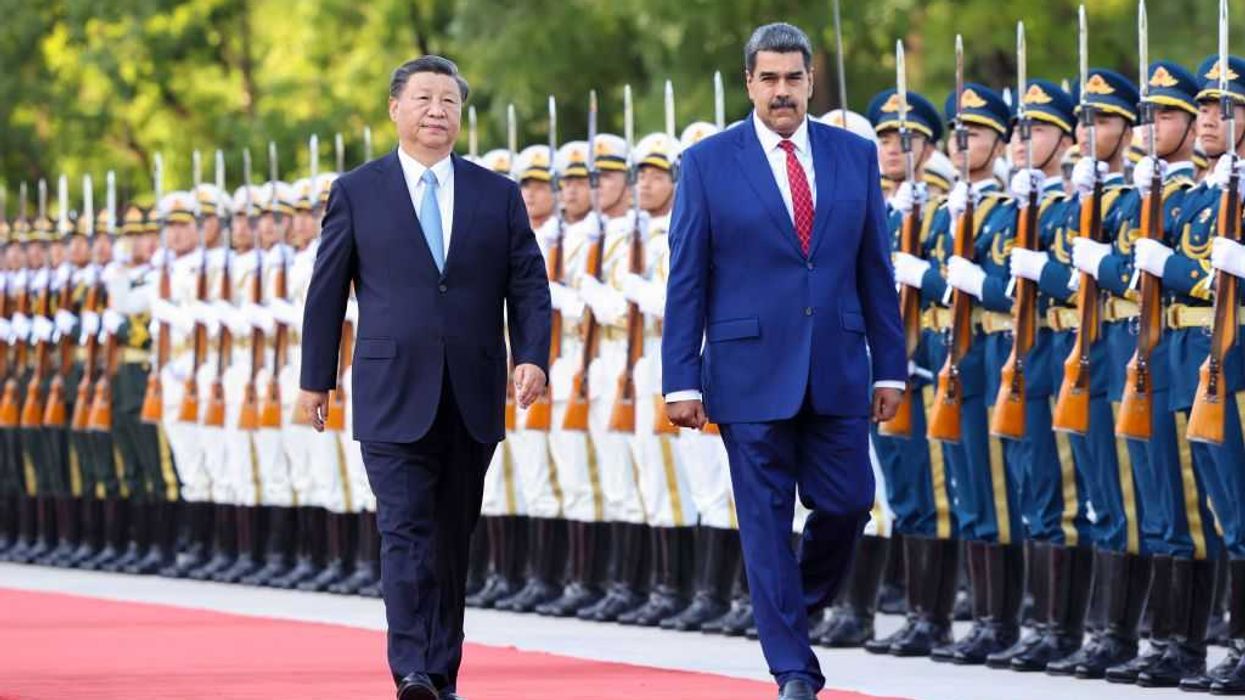

Category: China

Venezuela was the stage. China was the target.

Last weekend’s Caribbean live-fire exercise in and around the suburbs of Caracas delivered a steady stream of tactical messages to the Western Hemisphere. We don’t like narco-terrorists, wannabe communists, bloated dictators, or people who supply oil to our adversaries.

But that wasn’t the real message.

Message to Xi: There’s a new sheriff in town. He isn’t ‘Sleepy Joe.’ And his call sign is FAFO.

The love note was addressed to China, and it read: We are awake now. Our game is FAFO.

America’s 36-year slumber on the Monroe Doctrine — “Stay out of the Western Hemisphere or else” — began after Panama in 1990. The Gulf War and the Global War on Terrorism followed, and Washington became dangerously myopic about threats in America’s own backyard.

Then came the turning point. When Bill Clinton signed off on communist China’s entry into the World Trade Organization in 2000, Beijing rapidly surged into a world-class economic power. Along with that rise came a succession of Chinese leaders who openly advanced the idea of global Chinese hegemony.

Oddly enough, many of those ideas came from an American — my late friend Alvin Toffler.

Toffler’s book “The Third Wave” so impressed Deng Xiaoping and Zhao Ziyang in 1984 that millions of bootleg Chinese translations were distributed — without royalties — throughout the People’s Liberation Army. The same thing happened after Toffler published “War and Anti-War.” Once again, millions of pirated copies circulated, and Beijing began integrating his ideas into military doctrine.

In the late 1990s, PLA Major General Qiao Liang and Colonel Wang Xiangsui wrote “Unrestricted Warfare,” borrowing heavily from Toffler while laying out a strategy to defeat the United States.

In hindsight, it should have been titled “Slow Motion War.”

The book focuses on perceived weaknesses in American character and American war-making. The United States remains a nation of quarterly earnings reports and election cycles. We change political leadership every two or four years. The Chinese think in generational time frames.

From their perspective, Americans only go to war when facing a “clear and present danger.”

The genius of “Unrestricted Warfare” lies in exploiting what happens when a threat is clear but not present — like cancer from long-term smoking — or present but not clear, like the slow poisons Lucrezia Borgia allegedly used on her enemies.

Qiao and Wang proposed a slow, steady pressure campaign against the four pillars of American national power: diplomatic, information, military, and economic — the DIME.

Examples abound. Diplomatic and economic leverage through the Belt and Road Initiative. Tight control of information inside China paired with aggressive information warfare abroad through platforms such as TikTok. A decades-long military buildup aimed at surpassing U.S. power. And a long trail of currency manipulation.

(And then there’s this gem from page 191 of “Unrestricted Warfare”: “Can special funds be set up to exert greater influence on another country’s government and legislature through lobbying?” Eric Swalwell might find that line interesting.)

RELATED: From Monroe to ‘Donroe’: America enforces its back yard again

Photo by Tasos Katopodis/Getty Images

Photo by Tasos Katopodis/Getty Images

While America fixated on the Middle East, China quietly embedded itself throughout Latin America. In Panama, Beijing gained control of port management at both ends of the Panama Canal and began upgrading the system. In Costa Rica — which has no army — China donated 3,500 police cars and built a national stadium in San José, free of charge. It also cut sweetheart deals involving hundreds of Chinese fishing trawlers. Colombia saw similar treatment.

Then came Orange Man Bad.

Donald Trump is the first president to grasp that China isn’t a Red Godzilla stomping cities with napalm breath and a scything tail. China is more like the Blob — and Trump is Steve McQueen.

Venezuela, Maduro, oil, and narco-terrorism were all subsets.

China was the target. Xi Jinping was the bullseye.

Zero hour wasn’t set by the weather. It was set by the departure of Chinese envoy Qiu Xiaoqi, who had just wrapped up discussions on future ties with Venezuela. Unfortunately for Beijing, Delta Force snagged and bagged Nicolás Maduro and his wife and had them sitting in a Brooklyn jail before the envoy even made it home.

Message to Xi: There’s a new sheriff in town. He isn’t “Sleepy Joe.” And his call sign is FAFO.

Any questions?

China Takes Offense at Trump Declaring ‘This Is Our Hemisphere’ After Nicolas Maduro Raid

The Chinese Foreign Ministry on Wednesday took great umbrage at the U.S. State Department for proclaiming the Western hemisphere is “OUR hemisphere,” and interference from hostile foreign powers like China would no longer be tolerated.

The post China Takes Offense at Trump Declaring ‘This Is Our Hemisphere’ After Nicolás Maduro Raid appeared first on Breitbart.

Xi Jinping: ‘The Reunification of Our Motherland Is Unstoppable’

In a New Year’s address to the Chinese people, President Xi Jinping stated that “We Chinese on both sides of…

This Past Year Was Pretty Great. Here’s a Wish List for 2026.

Listening to the usual legacy media suspects, one might think 2025 was an apocalyptic wasteland of sorts — an authoritarian…

GORDON CHANG: China’s TikTok Deal Great For China, Not For America

Congress can step in

Currency Competition In The Digital Age

South Korea will become an unwitting participant if it is not careful

China’s Spy Network in America: A People’s War Against an Open House

Qian Xuesen, a Chinese rocket scientist and California Institute of Technology professor, worked on U.S. missile programs during World War…

Your laptop is about to become a casualty of the AI grift

Welcome to the techno-feudal state, where citizens are forced to underwrite unnecessary and harmful technology at the expense of the technology they actually need.

The economic story of 2025 is the government-driven build-out of hyperscale AI data centers — sold as innovation, justified as national strategy, and pursued in service of cloud-based chatbot slop and expanded surveillance. This build-out is consuming land, food, water, and energy at enormous scale. As Energy Secretary Chris Wright bluntly put it, “It takes massive amounts of electricity to generate intelligence. The more energy invested, the more intelligence produced.”

Shortages will hit consumers hard in the coming year.

That framing ignores what is being sacrificed — and distorted — in the process.

Beyond the destruction of rural communities and the strain placed on national energy capacity, government favoritism toward AI infrastructure is warping markets. Capital that once sustained the hardware and software ecosystem of the digital economy is being siphoned into subsidized “AI factories,” chasing artificial general intelligence instead of cheaper, more efficient investments in narrow AI.

Thanks to fiscal, monetary, tax, and regulatory favoritism, the result is free chatbot slop and an increasingly scarce, expensive supply of laptops, phones, and consumer hardware.

Subsidies break the market

For decades, consumer electronics stood as one of the greatest deflationary success stories in modern economics. Unlike health care or education — both heavily monopolized by government — the computer industry operated with relatively little distortion. From December 1997 to August 2015, the CPI for “personal computers and peripheral equipment” fell 96%. Over that same period, medical care, housing, and food costs rose between 80% and 200%.

That era is ending.

AI data centers are now crowding out consumer electronics. Major manufacturers such as Dell and Samsung are scaling back or discontinuing entire product lines because they can no longer secure components diverted to AI chip production.

Prices for phones and laptops are rising sharply. Jobs tied to consumer electronics — especially the remaining U.S.-based assembly operations — are being squeezed out in favor of data center hardware that benefits a narrow set of firms.

This is policy-driven distortion, not organic market evolution.

Through initiatives like Stargate and hundreds of billions in capital pushed toward data center expansion, the government has created incentives for companies to abandon consumer hardware in favor of AI infrastructure. The result is shortages that will hit consumers hard in the coming year.

Samsung, SK Hynix, and Micron are retooling factories to prioritize AI-grade silicon for data centers instead of personal devices. DRAM production is being routed almost entirely toward servers because it is far more profitable to leverage $40,000 AI chips than $500-$800 laptops. In the fourth quarter of 2025, contract prices for certain 16GB DDR5 chips rose nearly 300% as supply was diverted. Dell and Lenovo have already imposed 15%-30% price hikes on PCs, citing insatiable AI-sector demand.

The chip crunch

The situation is deteriorating quickly. DRAM inventory levels are down 80% year over year, with just three weeks of supply on hand — down from 9.5 weeks in July. SK Hynix expects shortages to persist through late 2027. Samsung has announced it is effectively out of inventory and has more than doubled DDR5 contract prices to roughly $19-$20 per unit. DDR5 is now standard across new consumer and commercial desktops and laptops, including Apple MacBooks.

Samsung has also signaled it may exit the SSD market altogether, deeming it insufficiently glamorous compared with subsidized data center investments. Nvidia has warned it may cut RTX 50 series production by up to 40%, a move that would drive up the cost of entry-level gaming systems.

Shrinkflation is next. Before the data center bubble, the market was approaching a baseline of 16GB of RAM and 1TB SSDs for entry-level laptops. As memory is diverted to enterprise customers, manufacturers will revert to 8GB systems with slower storage to keep prices under $999 — ironically rendering those machines incapable of running the very AI applications they’re working on.

Real innovation sidelined

The damage extends beyond prices. Research and development in conventional computing are already suffering. Investment in efficient CPUs, affordable networking equipment, edge computing, and quantum-adjacent technologies has slowed as capital and talent are pulled into AI accelerators.

This is precisely backward. Narrow AI — focused on real-world tasks like logistics, agriculture, port management, and manufacturing — is where genuine productivity gains lie. China understands this and is investing accordingly. The United States is not. Instead, firms like Roomba, which experimented with practical autonomy, are collapsing — only to be acquired by the Chinese!

This is not a free market. Between tax incentives, regulatory favoritism, land-use carve-outs, capital subsidies, and artificially suppressed interest rates, the government has created an arms race for a data center bubble China itself is not pursuing. Each round of monetary easing inflates the same firms’ valuations, enabling further speculative investment divorced from consumer need.

RELATED: China’s AI strategy could turn Americans into data mines

Grafissimo via iStock/Getty Images

Grafissimo via iStock/Getty Images

Hype over utility

As Charles Hugh Smith recently noted, expanding credit boosts asset prices, which then serve as collateral for still more leverage — allowing capital-rich firms to outbid everyone else while hollowing out the broader economy.

The pattern is familiar. Consider the Ford plant in Glendale, Kentucky, where 1,600 workers were laid off after the collapse of government-favored electric vehicle investments. That facility is now being retooled to produce batteries for data centers. When one subsidy collapses, another replaces it.

We are trading convention for speculation. Conventional technology — reliable hardware, the internet, mobile computing — delivers proven, measurable utility. The current investment surge into artificial general intelligence is based on hypothetical future returns propped up by state power.

The good old laptop is becoming collateral damage in what may prove to be the largest government-induced tech bubble yet.

Feds’ Case Against Ex-Democrat Aide Accused Of Working With China Hits Roadblock

Prosecutors said they intend to retry the case

Roomba maker iRobot files for bankruptcy, putting it in Chinese hands

Autonomous vacuums could go extinct unless they are made in the United States.

This is the harsh reality affecting companies like iRobot, the creator of Roomba, which just filed bankruptcy.

‘… with no anticipated disruption to its app functionality.’

Despite the company generating over $680 million in 2024, iRobot has been crippled by U.S. tariffs. Due to a 46% import tariff on Vietnam, iRobot’s costs were raised by $23 million in 2025, according to Reuters, which reviewed the court filings.

The court filings also reportedly noted that while Roomba is still dominating in U.S. and Japanese markets, it lost too much money on price reductions and investments in technological upgrades in order to maintain pace with its competitors.

According to the Verge, the company said it will continue to operate “with no anticipated disruption to its app functionality, customer programs, global partners, supply chain relationships, or ongoing product support.”

Simply put, after more than 20 years on the market, the Roomba is able to operate without online connectivity.

The bankruptcy will put iRobot under Chinese control moving forward, with the manufacturing company that controls its debt.

RELATED: The ultimate Return guide to escaping the surveillance state

Photo by: Andrew Lipovsky/NBCU Photo Bank/NBCUniversal via Getty Images via Getty Images

Photo by: Andrew Lipovsky/NBCU Photo Bank/NBCUniversal via Getty Images via Getty Images

Court documents reportedly showed that Picea, a Chinese manufacturer, purchased iRobot while taking its debt on board, which is estimated to be about $190 million. The vacuum company took on the debt in 2023 to refinance its operations, Reuters claimed.

The debt came even after Amazon paid a $94 million termination fee after backing out of a $1.7 billion acquisition deal in 2024, according to the New York Times.

It has not been that long since iRobot had a massive market value at $3.56 billion in 2021; it is now estimated to be worth just $140 million.

New owners Picea will take 100% ownership of the company and cancel the $190 million in debt, while also canceling a $74 million debt that iRobot owed through a manufacturing agreement.

RELATED: The AI takeover isn’t coming — it’s already here

Not only did iRobot need to deal with Vietnamese tariffs, other manufacturing that was established in Malaysia in 2019 was also likely affected.

It was not announced that Roomba had cut manufacturing from the country, and if it remained, would likely have been subjected to a 24% tariff rate from the Trump administration, which included taxing machinery and electronics.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

search

categories

Archives

navigation

Recent posts

- MEDIA MOB MALPRACTICE! Press Sec. Blasts Reporters for ‘Smearing’ ICE Agent After New Vid Drops — ‘Media Trust at All-Time Low!’ January 10, 2026

- ‘REVOLTING LIES’: CNN Refers to Suspected Gangmembers in DHS Confrontation as ‘Married Couple’ [WATCH] January 10, 2026

- FOOTAGE RELEASED: Cellphone Video Shows POV of Minneapolis ICE Agent Moments Before Shooting [WATCH] January 10, 2026

- RADICAL RHETORIC: DHS Blasts Sanctuary Politicians for ‘Unprecedented’ Spike in Assaults Against ICE Agents January 10, 2026

- ANTISEMITISM IN THE BIG APPLE: Protesters Chant ‘We Support Hamas’ Outside NYC Synagogue [WATCH] January 10, 2026

- Khamenei Blames Trump for Iran Protests as Regime Kills Dozens of Demonstrators January 10, 2026

- Trump’s Venezuela Operation Deals Blow to Another Dangerous Trade: Iranian Drones January 10, 2026